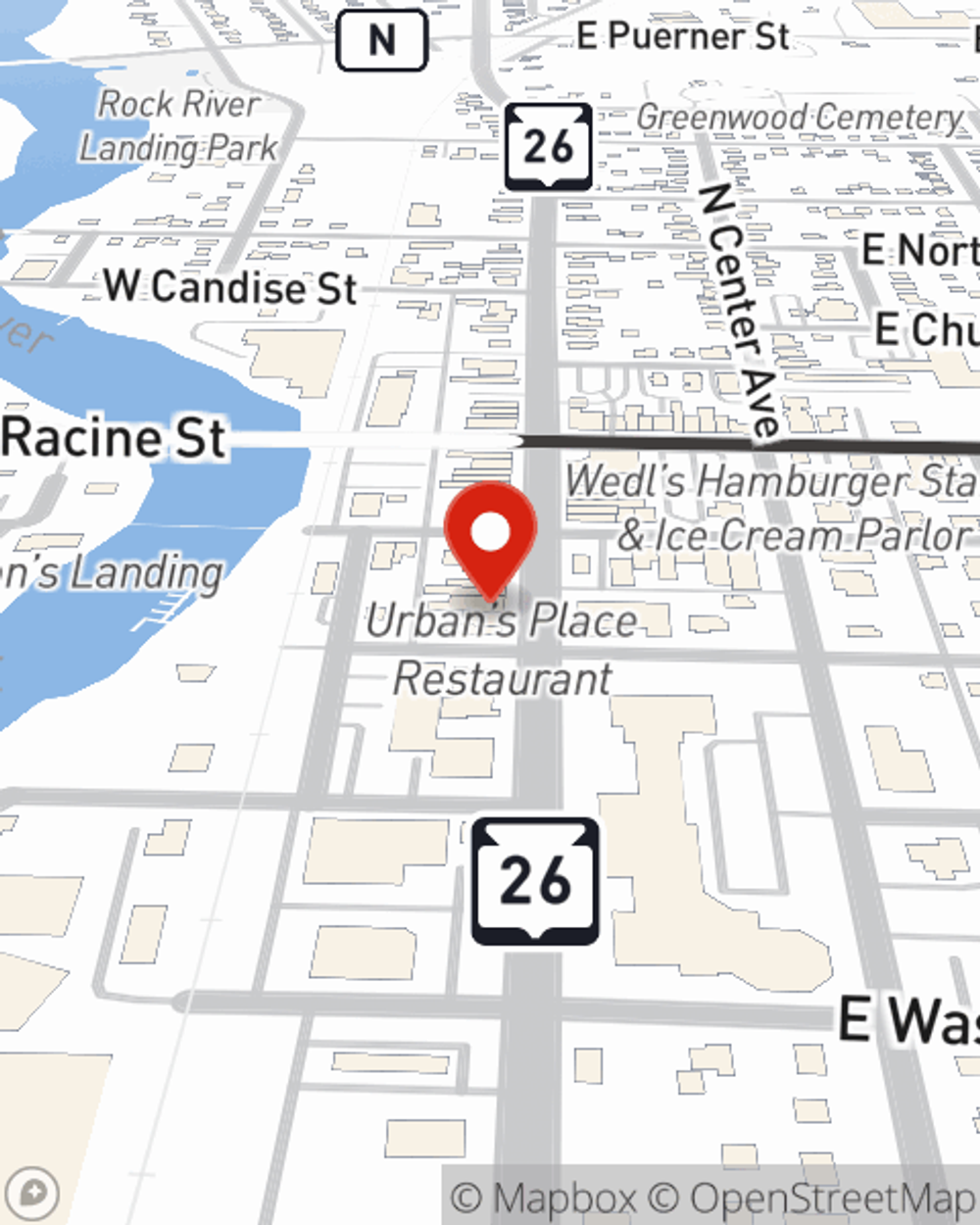

Business Insurance in and around Jefferson

Looking for small business insurance coverage?

Helping insure small businesses since 1935

- Jefferson

- Fort Atkinson

- Johnson Creek

- Watertown

- Helenville

- Lake Mills

- Jefferson County

- Dane County

- Rock County

- Walworth County

- Milton

- Janesville

- Edgerton

Your Search For Fantastic Small Business Insurance Ends Now.

Running a small business is hard work. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, contractors, retailers and more!

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Customizable Coverage For Your Business

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Eric Felth. With an agent like Eric Felth, your coverage can include great options, such as artisan and service contractors, worker’s compensation and commercial auto.

Let's talk business! Call Eric Felth today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Eric Felth

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.